Your winter Trustee bulletin 2022

News you might have missed

Change of investment manager

In June last year, following an in-depth review of our investment management business, we announced the appointment of BlackRock as the new investment manager of the assets directly under management for NAPS and APS. The assets were previously managed by our in-house team at British Airways Pension Investment Management Ltd.

We’re pleased to report that the transition of staff and management of the Schemes’ assets ran smoothly. Our new partnership with BlackRock is working well, performing in line with our expectations and delivering value for the Schemes.

The change of investment manager did not alter members’ pensions or scheme benefits in any way.

You can read more information and a Q&A in the original announcement.

April 2022 pension increase

Pensions in NAPS are usually increased each year.

If your pension is already being paid to you, the Pensions team provides a statement at the end of April each year with full details of the increase that will apply to your pension.

The increases are set out in the Government’s yearly Pensions Increase (Review) Orders (PIRO) and apply to any elements of your pension that qualify for yearly increases under the Scheme Rules.

In NAPS, these increases are limited to a maximum of 5% in any year. These Orders broadly reflect the increase in the Consumer Prices Index (CPI), but the Secretary of State decides how these are measured, and this may change from time to time.

The rise in the Consumer Price Index (CPI) to September 2021 was 3.1%. The Government is expected to use this rate for its Pensions Increase (Review) Order in April 2022.

Welcome, and a welcome back, to our newest Trustee Directors

In June you voted to elect Kate Gay, and re-elect Jack Weale, as member-nominated Trustee Directors (MNDs) from the pensioner membership.

They took up their positions on 28 June 2021 and 1 October 2021 respectively, and will serve for between five and five-and-a-half years.

MND Neil Blackburn’s term came to an end on 30 September 2021. We requested nominations from the employed deferred membership (Cabin Crew constituency) and Neil was re-appointed unopposed.

BA has appointed Dalriada Trustees Ltd, represented by Tom Lukic, to the NAPS Trustee Board.

In October 2021, BA appointed Natasha Franklin as an employer-nominated Trustee Director following the departure of Elizabeth Marsden.

You can find the full list of Trustees on the Trustee Directors page.

Helping to combat scams – new guidance

The Pensions Regulator has announced new guidance to trustees to help combat the rise of pension scams.

Now, if you haven’t yet drawn your NAPS pension and you request to transfer it to another scheme, we will need to carry out more checks than previously. We’ve updated our transfer pages with more information about these extra checks.

The Financial Services Compensation Scheme (FSCS) – what it is and how it can help

The FSCS might be able to help you if you transfer any or all of your benefits out of a pension scheme, such as NAPS. You may be able to claim compensation through the FSCS if your new provider or adviser later goes out of business.

It is an independent, free-to-use service if you’ve been let down by financial firms.

It can step in to pay compensation for a range of financial products, including certain pensions.

If you’re thinking about transferring out of the Scheme, check your potential new provider is FSCS protected.

For more information, visit the FSCS website.

Our Notice of Wish campaign - Looking after your loved ones – an update for our Deferred members

Many of you responded to our previous story and emails last September asking you to make sure your beneficiary details are up to date. This helps make sure the right people get any lump sum allowance or Adult Survivor’s pension that is due if you die.

If you haven’t yet completed a Notice of Wish form, or if you haven’t updated yours in a while, then please do so now. It only takes a few moments.

We, the Trustee, make the final decision about who receives any benefits due. This form helps us take your wishes into account and allows the benefit to be paid free of Inheritance Tax.

Not completing the form could mean that your benefits are paid to someone without taking account of your up-to-date wishes; or it could take longer for us to determine who to pay your benefits to.

In Focus retirement survey

We included a retirement survey in our 2021 edition of In Focus to find out how our retired members planned for their retirement. We also wanted to find out how we might improve the journey for members who are approaching retirement.

What did our retirement survey reveal?

- More than 75% planned for retirement

- 90% had at least some idea about their pension and options – either by using our online pension modeller or by asking for a retirement statement from our Pensions team

- Nearly half discussed their retirement options with family, friends or colleagues. A further 40% discussed their options with our BA Pensions team, an organisation offering free pensions advice (such as Citizens Advice, the Pensions Advisory Service or PensionWise – both now MoneyHelper -) or with their financial adviser

- Only 36% of retirees attended one of the pre-retirement seminars run by BA Clubs. These are currently run as virtual webinars

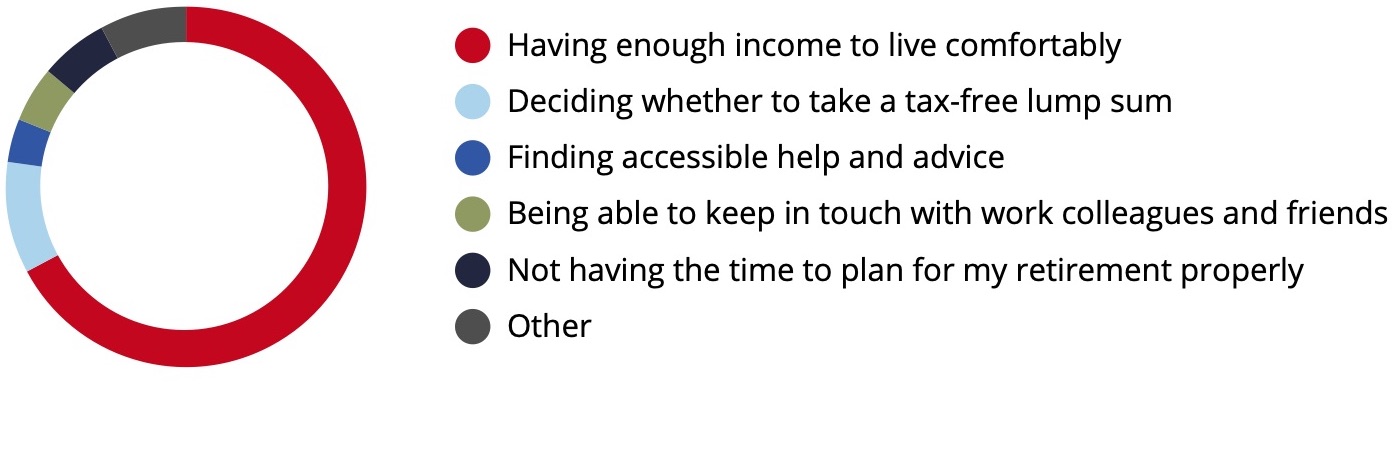

Things that most concerned our members about retiring/drawing their pension

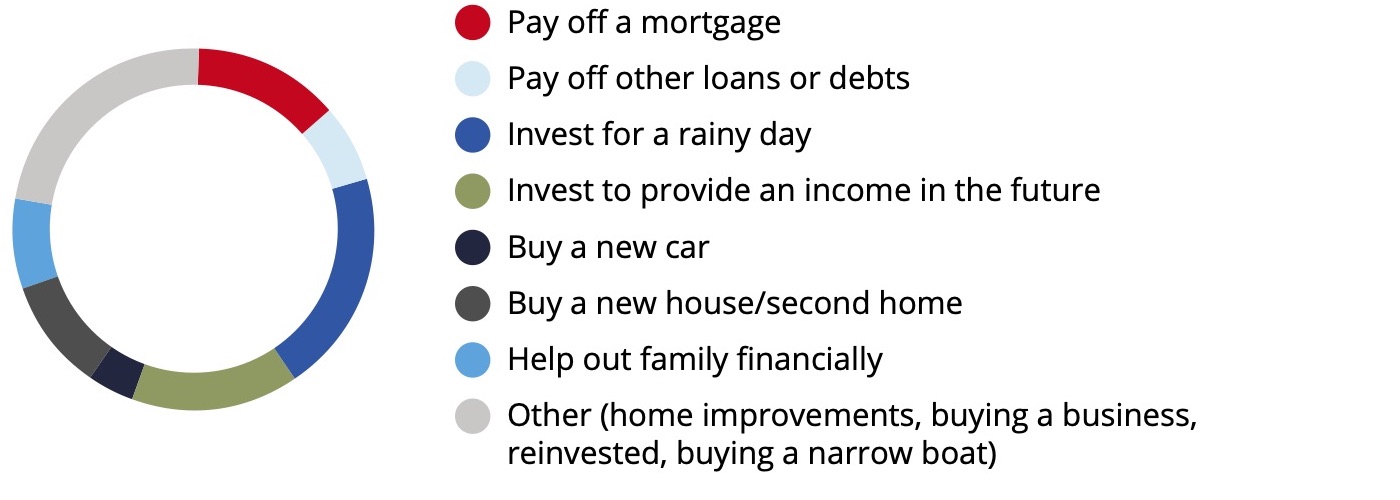

How members have used the tax-free lump sum available from their pension

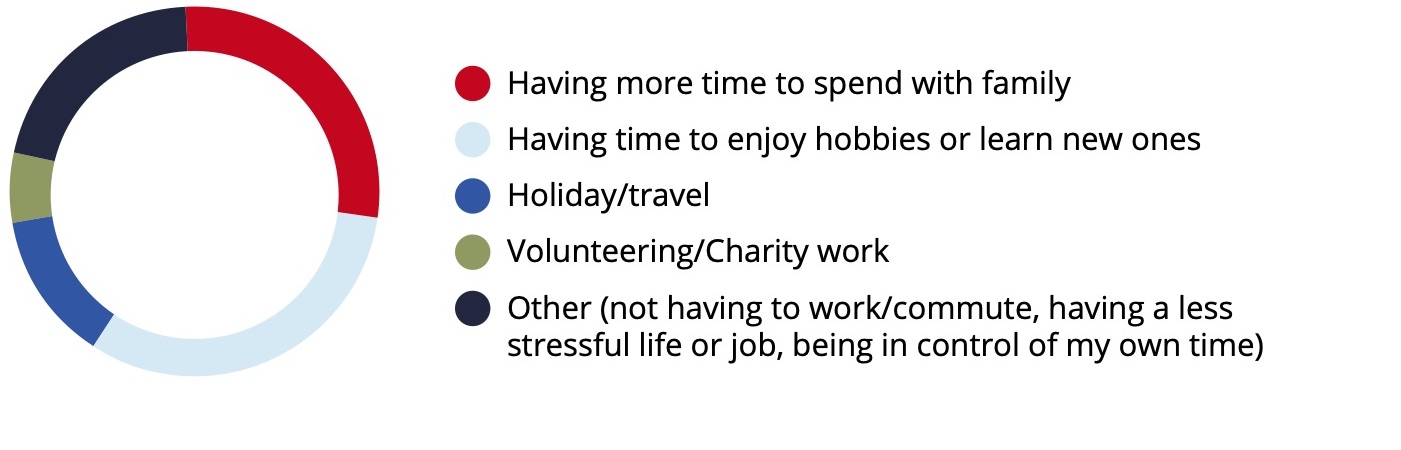

What our retirement members are enjoying most about retirement

And congratulations to Mrs Sharma from Kingston upon Thames who was randomly selected as our lucky survey competition-winner and received an iPad. Mrs Sharma said: “When I received your email I was very surprised as I NEVER win anything. I have today received the iPad and will have great fun in setting it up. In future I will always succumb to a free survey because you never know!”

Thinking of retiring?

You have some important decisions to make and steps to take if you’re ready to retire soon.

Think about what you want to get out of your pension and how to achieve it, as this might make a difference to how you decide to take your benefits.

If you’re considering retiring, take part in one of the online pre-retirement courses run by BA Clubs. It’s a good idea to check your figures on your most recent benefit statement, use our online pension modeller, or request a retirement quote from the Pensions team.

Remember to track down any other pension benefits you have so you can work out what your total income is likely to be in retirement. Your State Pension entitlement is in addition to your BA Pension – you can check your State Pension forecast (you can do this online at www.gov.uk/check-state-pension). It’s also worth thinking about getting independent financial advice when you know what your options are.

When you're ready to retire

- Call or contact the Pensions team to request a retirement pack which, among other useful information, includes a cash equivalent transfer value (if you’re within four months of your normal retirement date, they’ll send you a pack through the post automatically)

- Login to Mybapension Online and submit your Retirement Options form to the Pensions team online.

- Enjoy your retirement!

Read Mary’s story about her route to retirement in our last In Focus.

Your lifestyle in retirement – how much will you need?

The Pensions and Lifetime Savings Association (PLSA) has developed a set of Retirement Living Standards based on independent research by the University of Loughborough.

Each of the PLSA’s three standards shows you what life in retirement looks like and what goods and services you’d be able to afford at each level.

| Single | Couple | This affords... |

|---|---|---|

| Comfortable £33,600 | Comfortable £49,700 | More financial freedom and some luxuries |

| Moderate £20,800 | Moderate £30,600 | More financial security and flexibility |

| Minimum £10,900 | Minimum £16,700 | Covers all your needs with some left over for fun |

Don’t forget to include your State Pension and any other pensions you expect to receive when you calculate what your retirement income could be.

Find out more about the PLSA’s Retirement Living Standards and what each standard includes.

Do you have Additional Voluntary Contributions (AVCs) invested in the Short-dated Gilts fund (SGF)?

We recently ran a campaign highlighting the low interest rate that applies to any money held in the SGF.

Over the past five years, the SGF has been the lowest performing of the three AVC Funds. If you currently have AVCs invested in SGF or you’re considering investing in the SGF, please read our SGF guidance leaflet.

There are three AVC investment funds: the Mixed Portfolio Fund (MPF), the Equity Biased Fund (EBF); and the Short-dated Gilts Fund (SGF). You can easily switch your AVC investments between the available funds using our Smart AVC e-form. Switch requests received before the 20th of a calendar month will be applied on the first day of the following month. Simply login to Mybapension Online and click the Smart AVC e-form to find out what your current AVC investments are and to make any investment switches. You can also visit our AVC page for more details and resources for your AVCs.

Always consider taking independent financial advice when making decisions about your pension and investments. Find a local independent financial adviser.

Statement of Investment Principles (SIP) Implementation Statements and our Responsible Investment report

You can find out about the principles that govern our decisions about your Scheme’s investments in our 2021 Statement of Investment Principles.

As part of our responsibility to you and to your benefits, we also produce an Implementation Statement to set out how we have put the policies under the terms of the SIP into practice. As part of our commitment to make your Scheme information more accessible, we have published two versions – a short, easy to read Summary Implementation Statement and, if you want to read a more detailed copy, you can read our full Implementation Statement – both are on our Scheme documents page.

These documents set out how our policies under the terms of the SIP have been put into practice.

Our Responsible Investment report highlights your scheme’s approach to investment stewardship and provides an insight into how we expect environmental, social and governance (ESG) matters to be considered as part of the investment decisions made on our behalf.

Our 2021 Annual Report and Financial Statements now available

Visit the Scheme documents page to view the annual report and financial statements for the year ending 31 March 2021.

The report covers issues around governance, funding, investment and administration, as well as important events between the year-end and publication date.

Find out more about:

- How the Scheme’s investments have performed

- How we’re managing investment risk

- Changes to your Trustee Board

Guaranteed Minimum Pension (GMP) update

Everyone who has been a member of NAPS at any time between 6 April 1978 and 5 April 1997 (except married women or widows who paid a special reduced rate of National Insurance contributions) will have a GMP. Your GMP is the minimum amount of pension your Scheme was required to pay you from age 60 (women) or age 65 (men).

You may recall from our spring 2019 edition of In Focus that, following a decision made by the High Court, all UK pension schemes with pensions which include GMP-related benefits should equalise their GMP benefits to eliminate any gender-related differences. For NAPS members, this might result in a small backdated increase to pensions paid to some of our pensioners.

We have carried out a detailed comparison of our records to those held by HM Revenue and Customs ready to start an equalisation project.

This is a complex task and will take some time but we’ll continue to keep you informed of our progress and we’ll contact affected members directly with any updates.

You can find out more about GMPs on the GMP page